Relativity Space wants to be the first company to launch an entirely 3D-printed rocket into orbit and it wants the Pentagon as a customer.

While the COVID-19 pandemic has thrown a wrench into plans, a growing number of companies are looking to provide small and medium launch services to the U.S. government. The establishment of the U.S. Space Force, Space Development Agency and U.S. Space Command in 2019 signaled the Pentagon’s ambitious plans for launching more payloads into space, and providing a vehicle for just a portion of those launches would prove lucrative to any company.

RELATED

For Vice President of Business Development and Government Affairs Josh Brost, Relativity Space stands out from the competition, bringing disruptive 3D printing technology to bear on the small launch sector. Prior to joining Relativity, he worked at SpaceX for nine years, where he was responsible for the company’s government sales.

Even as the company works toward the launch of its first Terran One rocket in fall 2021, Relativity has worked to secure contracts in the commercial world. In June, the company announced it had secured a deal with Iridium Communications for six dedicated launches to low Earth orbit, with the first launch taking place no earlier than 2023. That same month, Relativity also announced a Right of Entry Agreement with the 30th Space Wing for development of rocket launch facilities at Vandenberg Air Force Base.

Recently, Brost and Relativity Space co-founder and CEO Tim Ellis spoke with C4ISRNET about how the company plans to win launch contracts with the U.S. government.

This interview has been lightly edited for length and clarity.

C4ISRNET: How is Relatively Space approaching the U.S. defense and intelligence community launch market?

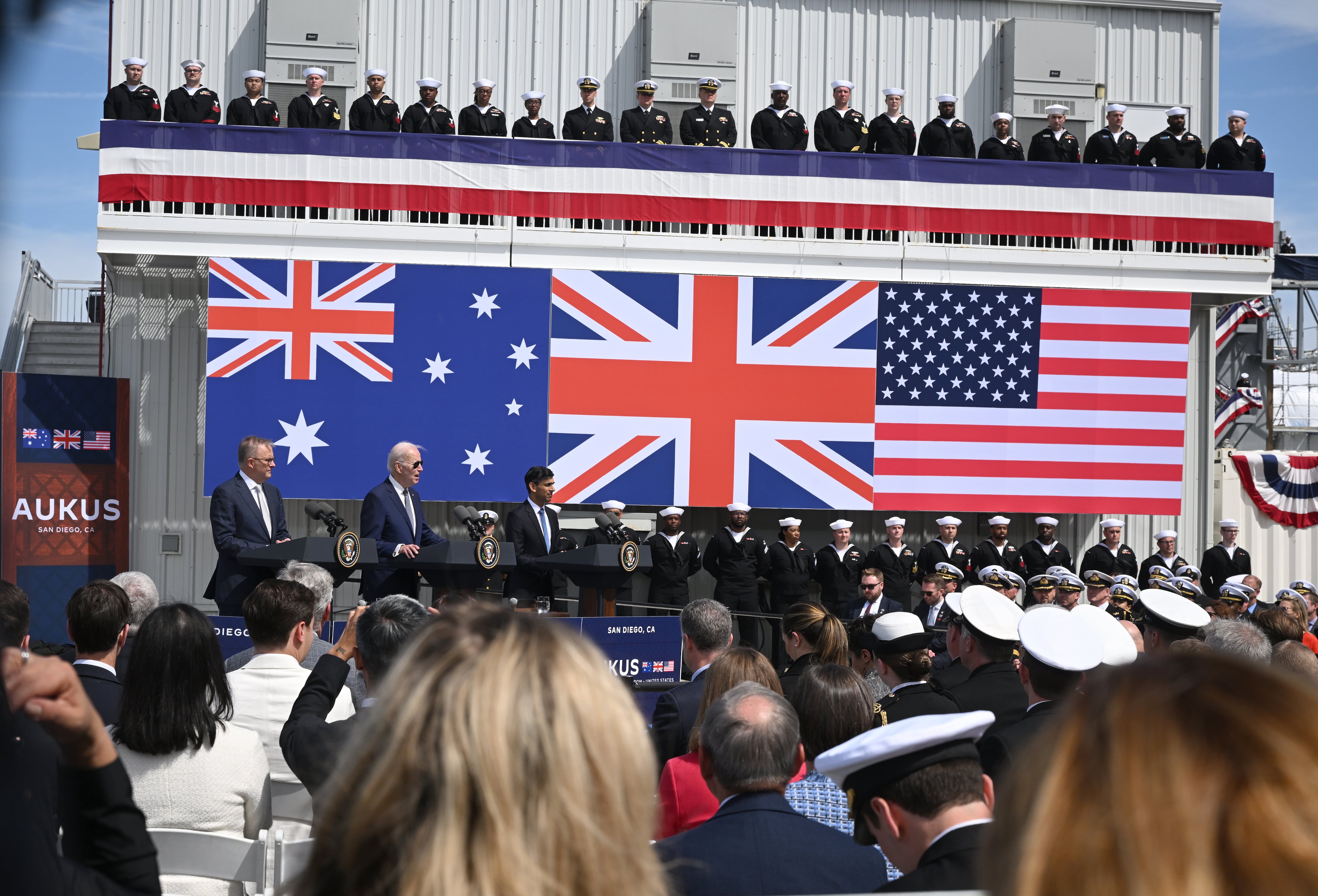

BROST: We see the national security customer base as a really important long term customer for us. I think you know, that the main buyers of launch within the national security sector, are the Air Force through their small launch group, the Kirtland Air Force Base in Albuquerque, New Mexico. But in addition to that, you do have [the National Reconnaissance Office] that buys some launches themselves directly, you’ve got the Space Development Agency that maybe buys launches directly as well as DARPA. We have existing relationships with with all of those different entities. And while we’re still in development, we have been bringing them along with our developments and getting them excited about what we’re doing differently.

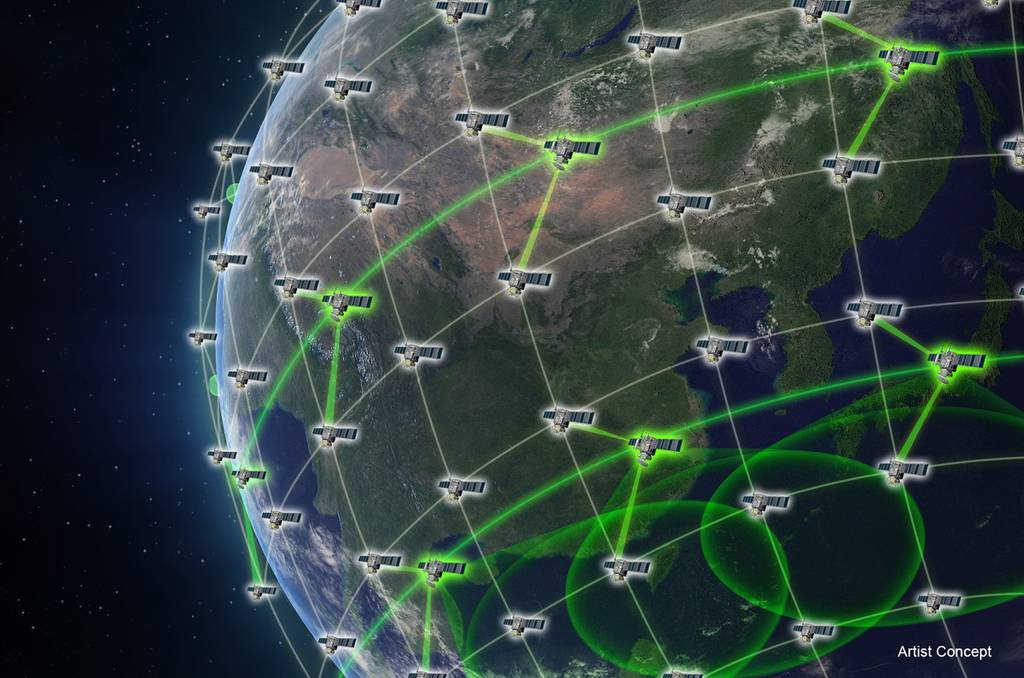

If you look at what the spacecraft that are being developed by the Defense Department at this point in time, you’re seeing a really rapid growth in the interest and need for for smaller satellites that are offering more distributing capabilities. So you got the Space Development Agency working on their demonstrations, you have DARPA working on their demonstration of a whole new way of building resilient space architectures which are predicated on more smaller spacecraft.

And then if you look, again, on the way we’re building the launch vehicle, with the 3D printing, we’re gonna be able to go from raw materials flight in just 60 days, where normally it would take something like 18 months to two years to build a small launch vehicle.

RELATED

C4ISRNET: Can you give me some numbers around your pricing, to give us a little more perspective? I mean, how are you shaping up to what you see as the competition right now?

BROST: We do post our launch vehicle price on our website. It’s $12 million for the full capability of Terran One. And that vehicle can take a little over 1250 kilograms to low Earth orbit. So that puts us at just under $10,000 per pound to orbit. In the small launch space, most or basically all of the other launch vehicles that are out there have lower capacity than us and most of them charge the same or more per mission. And so the math becomes pretty simple for the dollar per pound comparison.

C4ISRNET: What do you think is a healthy mix as far as what proportion of your business will be defense related as opposed to commercial launches? Say 10 years down the line, what’s the mix you’re looking for?

ELLIS: When we’ve looked at market analysis, overall, I think we can get to something that’s pretty close to 50/50. There’s certainly a very robust and growing commercial launch industry and, you know, lots of low Earth orbit constellation providers that are looking to develop capability. [There are] other markets — low Earth orbits, medium Earth orbit as well as geosynchronous — which we can actually serve with our launch vehicle and a kind of final kick stage third stage, that we have a launch agreement with Momentous Space offer. So we can reach all of these different orbits for commercial customers, which we see being a several billion dollar per year opportunity. And then on the defense side, we’re seeing similar activity. There’s a whole bunch of these low Earth orbit programs that are being investigated, as well as other capabilities that we think will make the government market robust.

Nathan Strout covers space, unmanned and intelligence systems for C4ISRNET.